Half-timbered homes: buy, renovate or sell historic homes with beams? Comparison & tips

Buying a half-timbered house – Investing in a property or selling a house is always a question of the right approach. This is especially the case with historic buildings such as half-timbered houses. The cute, historic buildings are especially common in our latitudes, but is it worth the investment in such an old masonry or is it better to bet on a new building? Everything about architecture, renovation and especially financing of a half-timbered house we tell you in this article. Here you can return to the overview with definitions and advantages and disadvantages of the most common types of houses.

Half-timbered house: architectural style, features and architecture

Everyone who grew up in Germany has seen them. But how exactly it is to live in such a house, you probably only know once you get the chance. However, the houses are not for everyone and require a lot of work. You can read about how the construction method influences the living atmosphere here.

Let’s start with the part that seems more interesting to some and not so interesting to others, but which is the basis for understanding the peculiarities of the houses. If architecture doesn’t interest you at all and you’d rather get straight down to the nitty gritty, then just skip ahead to the advantages and disadvantages of the house form.

Half-timbered houses were a good option in the 17th century for building houses from locally available materials. The construction of half-timbering is extremely sophisticated, because the positioning of beams and supporting beams requires great care. In return, at the end of the house construction there was a wind and weather resistant building, which was even able to store heat.

You want to buy or build a house, but don’t know which one is right for you? Then take a look at our guide to house types from A – Z! Here you will find all house types, from bungalow to terraced house!

Construction method: Features and differences

With the industrialization and increasing networking of the world, the local availability of building materials has moved into the background, because the required materials can be imported much easier. However, half-timbered houses are characterized then, as now, by their basic construction of wood.

The exposed wooden beams are also what make up the charm of the houses for many. So if you are thinking of rebuilding a house in the half-timbered style, it is advisable not to plaster it, because that would destroy the characteristic for many.

Before building, you should definitely find out whether the plot of land you have chosen allows for the construction of half-timbered houses. The easiest way to find out whether this is the case is to consult the land register, which is worth looking at anyway before buying a property or house.

In any case, it’s important to know that sourcing materials, as well as finding an engineering firm or architect who knows about timber framing, can be much more difficult than with other types of houses.

Advantages & disadvantages of a half-timbered house: renovation, ancillary costs and more

The positive and negative effects of the shape of the house depend entirely on whether it is a new or an old building. When the building was last renovated can also play a role by having a significant influence on the circumstances of the house.

Advantages: Charm and sustainability?

What makes a timber-framed house special for you personally? This question has a variety of answers, but often the pro argument is sentimental value. Whether you grew up in a town surrounded by half-timbered houses, grandma lived in a half-timbered house, or you’re just fascinated by historic construction, a lot of things make the style special. Plus, a half-timbered house has a lot going for it architecturally:

- Historical charm

- Sustainable construction

- Stable construct

Disadvantages: Redevelopment, monument protection & Co.

Especially the purchase of an old half-timbered house is not exactly associated with the best. Unfortunately, these prejudices are often true. An old building like a half-timbered house often falls into energy efficiency classes E-H, which means it incurs a lot of ancillary costs. In addition, one or the other stone is put in the way during renovation.

- Often in need of renovation

- Monument protection

- Elaborate search for experts

Refurbishment: costs, effort and whether the investment is worthwhile

Buying an old half-timbered house and refurbishing it – many people think this is an option to get a nice home at a reasonable price. This idea comes from the fact that old half-timbered houses are often cheap to get, but there is a reason for that, because the refurbishment of the historic old buildings can go quite into the money. We have found out for you what costs you can expect and what additional hurdles you will have to face.

Refurbishment costs and subsidies: Prices & tips

Are you thinking of buying and renovating a half-timbered house? Then let that go through your head again, because a renovation, especially of a half-timbered house is really expensive. In general, you can expect that, depending on the condition of the property, the preparation costs about 1,200 € / sqm. This is almost the same price that you pay for a new building.

The only advantage: the refurbishment of the old buildings is supported by subsidies. Namely in the form of a loan with a repayment subsidy. Other options to finance the construction of the house and what exactly is hidden behind the different forms of credit, we tell you in the course of this article.

Monument protection: How do I find out whether my house is a listed building?

In itself, historic preservation is a positive thing, because it aims to preserve historical memories and bring a piece of the past into the present and future. However, at the same time it sometimes makes it difficult for buyers of old buildings, especially often half-timbered houses, to enjoy the conversion of the house.

Finding out whether a house is a listed building turns out to be quite easy. A simple phone call to the Historic Preservation Office is often all it takes to get the information. Just have the address of the property ready and simply ask.

Investment: Half-timbered houses as an investment or for asset accumulation?

Of course, it is possible that a refurbished half-timbered house brings in more money than you originally put into the good piece. However, one often used up time for information gain, endless planning and nerves, the upgrade has cost not counted in the cost calculation.

You only see expenses vs. income, but that’s a mistake because there is actually money to be made in real estate, but not so much by upgrading timbered houses, but rather by investing smartly. Should you continue to be convinced about upgrading a timbered house, hopefully we’ve already given you some ideas, but here we’ll tell you how to use real estate as an investment and increase your money.

Open and closed-end real estate funds: Real Estate Investments & Funds

Especially if you’re not quite in a position to buy your own property yet, real estate funds are a great way to make money in real estate with comparatively little risk. Open-ended real estate funds constantly change their portfolio, while closed-end real estate funds maintain their investments.

Investment funds work according to the community principle. This means that the fund starts with a certain basic amount. This is invested proportionately in various real estate projects. Which projects these are depends on the theme of the fund and the manager. You are part of a group of investors who share the investments and thus also the returns. Your profit is therefore determined by the performance of the fund and the amount of money you want to invest.

It is especially important for us to tell you that you should only invest money that you have at your disposal, because investments on the capital market should, unless you are experienced in trading, be long-term to yield profits. Also a conversation with bank advisors makes sense in case you want to gain first experience in the financial market.

Making profits from property rentals: Tips for landlords

If you look at the topic of earning money with real estate, you will always find the statement that renting is the only option to earn money with real estate in the long term. But how much money can you actually earn by renting out and what taxes do you have to pay in the course of rental income? We’ll tell you.

If you are still paying off the property, you will of course have to pay regular instalments to the bank. Apart from that, you pay taxes on renting and leasing properties. In addition, there are maintenance costs and, depending on the rental agreement, minor repairs. Is your rented property a holiday home and you are not on site for most of the year? Then you may have to deduct additional costs for a service provider from your income.

Profit = Rental income – (Taxes + maintenance + house payments + additional service charges)

Capital investments: Interviews & tips from experts

The points mentioned here are reported very neutrally, so that you can form your own opinion about the options of investing in real estate. If you want to know more about real estate as an investment, the advantages and disadvantages of funds and how real estate compares to other investments, then you can visit this article, where we among other things about the comparison of money investment in gold and real estate:

Buying property: What to look for in timber-framed houses

You’ve been thinking about buying a half-timbered house for a while now, or at least you can’t get the idea of owning one out of your head? Then we offer you here exclusive tips on how to find the perfect property for you and what you should pay attention to so that your investment has a particularly high probability of being profitable.

Checklist for timber-framed houses: efficiency class and ancillary costs

What does a half-timbered house have to offer to make the investment worthwhile? Particularly with half-timbered houses, great care is required when buying, because hidden traps can open up after the purchase if you have not already paid attention to the details of the house in advance.

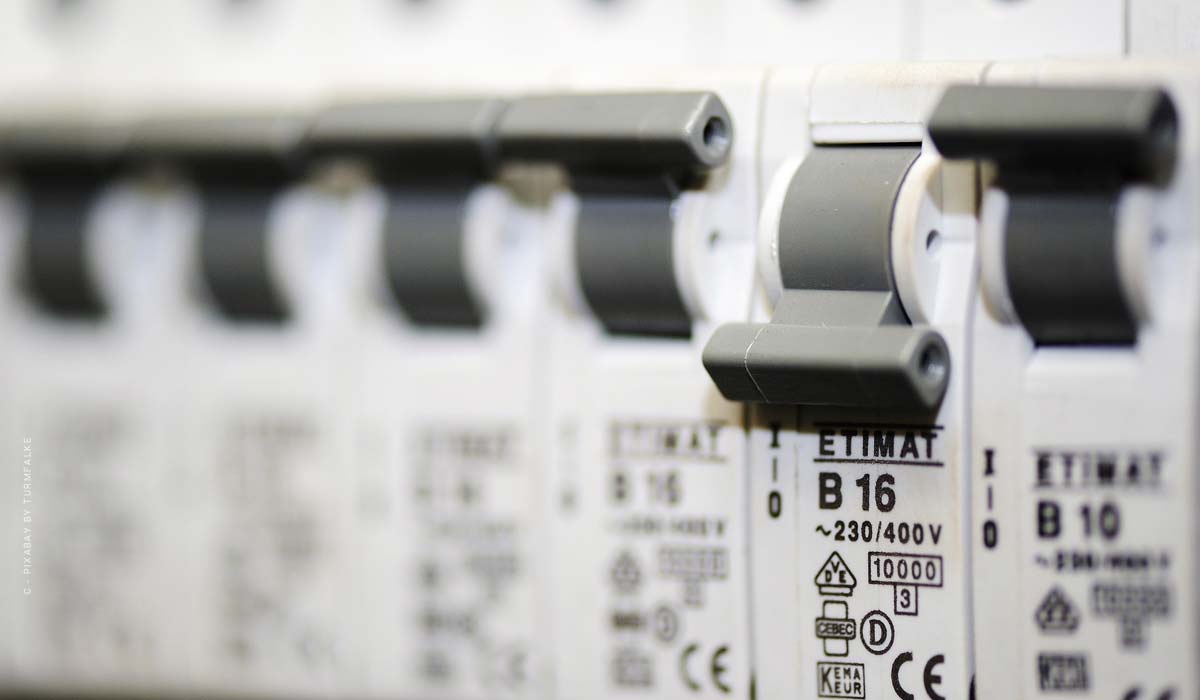

Of course, the age and condition of the house are particularly important. How much renovation is the property in need of, what does the insulation look like and what is written on the energy certificate, because this provides information about the consumption of the house in primary energy in kilowatt hours per year and square meter. This also quickly reveals potential heating costs

It also helps to identify the need for optimisation of the house. And don’t forget: renovations of the heating, ventilation and energy system are subsidised by the state. You should pay attention to the following things:

- Monument protection

- Insulation

- Energy efficiency class

- Heating system

- Ventilation

House building & house purchase financing: useful tips and options

To make sure that nothing stands in the way of your dream of owning your own home, we have summarised a few popular financing options. If you want to learn more about the individual topics, click on the link below the summary to be redirected.

Annuity Loans: Explanation, advantages & disadvantages

This loan is the most frequently chosen form of real estate financing. Annuity loans are very easy to adapt to your own circumstances, as the repayments can be spread flexibly over the repayment period. The time period can also be adjusted quickly and offers options from 5 – 30 years depending on the amount of the loan and personal creditworthiness. Annuity loans currently offer the most favourable, constant interest rate.

- Annuity Loans: Advantages, disadvantages, repayment plan and explanation

Building loan: Interest, calculation & Co.

For a construction loan it is equally important to fit the creditworthiness of the individual. For this reason, it makes sense to compare the offers of different providers to find the right one for you. Because building loans are often fixed offers, which are less flexible in the interpretation, but also partly offer very attractive interest rates.

-

Construction Loan: Current interest, interest rate, interest rate development, calculation.

Real estate loan: equity, interest, tips & comparisons

You’ve already found the right house and don’t even need to build it? Then take distance from the construction financing and look around at real estate loans. It is important with the real estate loan, as with all other financing options, that you do not use any offer from the Internet, but compare, get advice and make personal requirements. These should be adapted to your own financial requirements.

-

Real estate loan: bank, loan, equity, interest, comparison + tips